The 2025 Operating and Capital Budget for the City of Thunder Bay supports the 2023 – 2027 Maamawe, Growing Together Strategic Plan, fostering an inclusive city focused on service excellence, collaboration, and providing opportunities for a high quality of life.

The City of Thunder Bay prioritizes accountability, transparency, and inclusiveness in its Budget process. The current budget has been designed to most effectively use the City’s financial, technological, and human resources to deliver key City services.

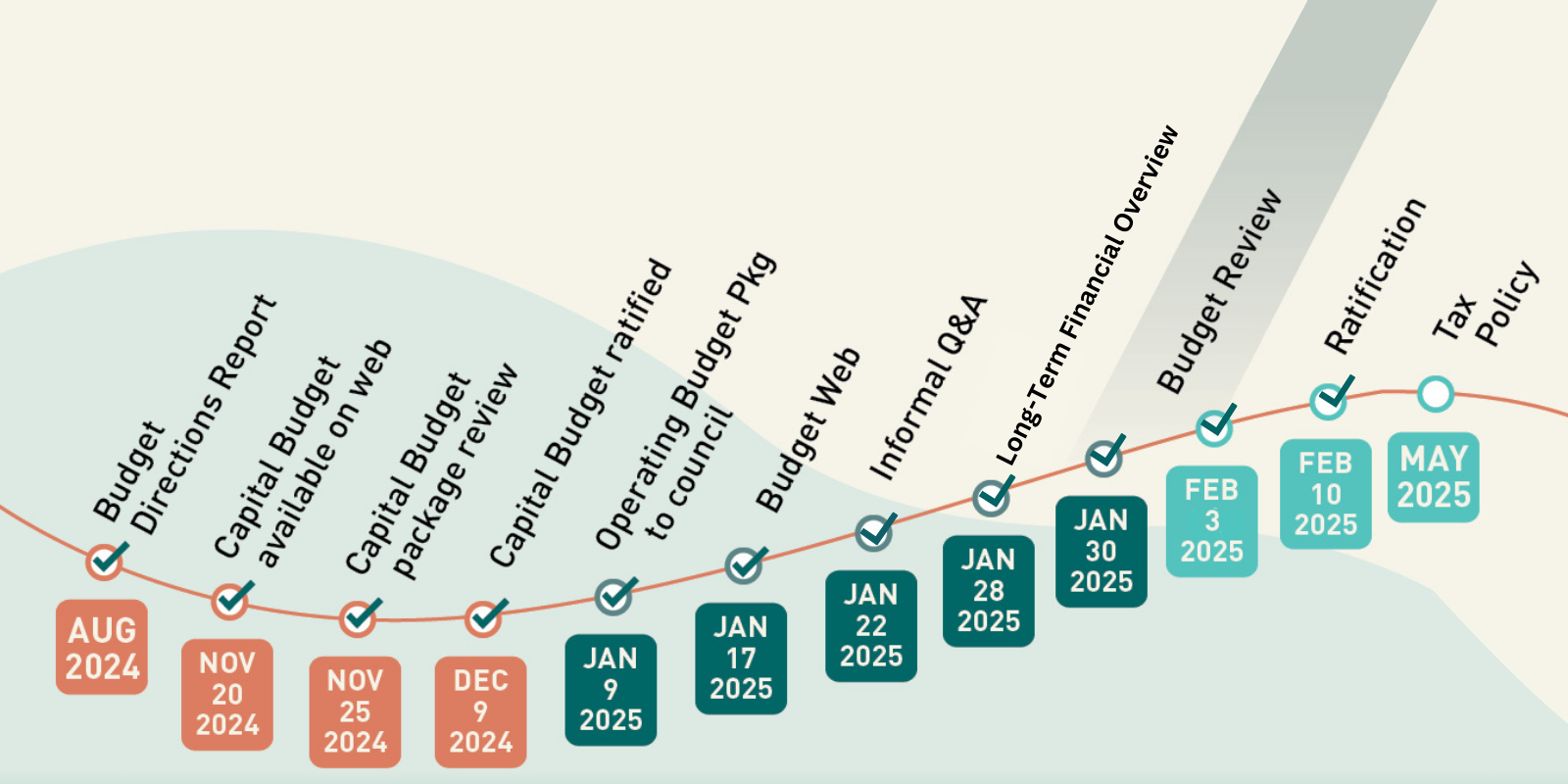

City Council approved the 2025 Capital Budget on December 9, 2024, and the 2025 Operating Budget on February 10, 2025.

What is the difference between "tax-supported" and "rate-supported"?

Tax-supported portions of the City budget are funded through property taxes and fund a variety of services that contribute the health, safety and quality of life of the city. The rate-supported portion of the budget is fully-funded by fees applied only to users of the service.

2025 Budget

2025 Budget - City of Thunder Bay - Volume 1 - Summary

2025 Budget - City of Thunder Bay - Volume 2 - Operating Budget

2025 Budget - City of Thunder Bay - Volume 3 - Capital Budget

Contact Us